The Bears are Back: Investing in a Bear Market

Adapted from a Letter Sent to My Private Wealth Management Clients on May 19, 2022

The Bear Market is Back: Financial Management in Down Markets

The bears are charging through Wall Street, and stocks are falling! Should we run?

No, we DO NOT run from bears—in the wild or in the markets!

“The Bulls and Bears in the Market” by William Holbrook Beard, 1879 “The hue and cry of the Stock Exchange, the vast nervous energy, the terrific passions and the tragedies and successes of that maelstrom of life in the nineteenth century have never before been suggested with such vividness and power." -New York Historical Society excerpt of an analysis of Holbrook’s “The Bulls and Bears in the Market.”

This is the only piece of artwork on the walls of my office. I paid a couple hundred dollars to have a large print of it nicely framed—the only time I’ve done such a thing. Why? Because Holbrook’s 1879 work reminds me that market returns have never come in polite averages, and the attractive long-term performance numbers printed on financial statements are only attainable by braving the age old violence and ravages of bear markets.

In the midst of the 2020 pandemic-related market crash I wrote:

The good news is that we’ve been through this before—and we’ve survived! We are prepared, we know what to do, and we know what not to do. A couple of things to keep in mind:

Our retired clients are positioned in the same types of portfolios that retirees have safely lived off through past bear markets.

Our clients who are still working and accumulating wealth may not realize it now, but will surely look back on this as an opportunity to buy great companies on sale.

Most importantly, we know that for anyone holding diversified portfolios, we DO NOT RUN. We do not want to “sell low,” likely locking in losses and missing the recovery.

Stock markets have recovered from 100% of past bear markets. Not all individual company stocks have recovered; in fact, many have fallen victim to economic crises, but the broad basket of company stocks has been a wealth builder throughout the ages, despite suffering many bear markets along the way. (Click here for my full “Do Not Run from Bears” post.)

This strategy holds true today.

We know our portfolios will bend under the pressures of a bear market, but history lends confidence that they will not break. We will undoubtedly see headlines reporting failures and complete losses in many speculative endeavors and individual positions. Although the past is not a guarantee for the future, our experiences have repeatedly shown that highly diversified portfolios of high-quality companies have stood the test of time for investors who have stood their ground!

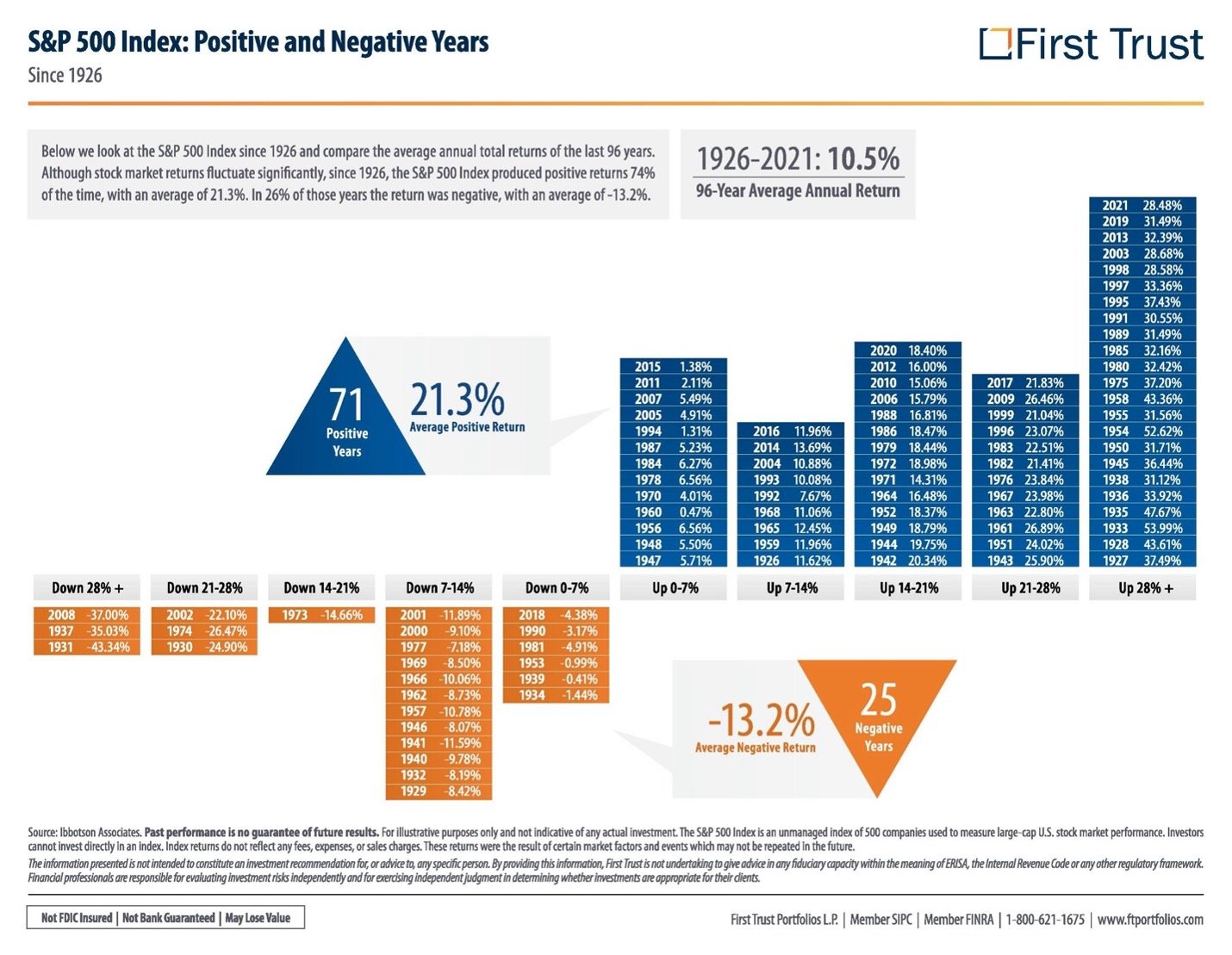

To help visualize the bull and bear markets of the past, First Trust compiled a couple of confidence-inspiring charts (below) pointing to the overwhelming long-term success of the BULLS in the market!

As always, please feel free to contact me if you’d like to discuss the current market factors or your portfolio and individual financial plan in more detail.