Financial Market Forecast: Roaring '20s Revisited?

The following post is an excerpt adapted from a letter sent to my financial advisory clients in May 2021.

Stocks are soaring, real estate is booming, unemployment is falling, and interest rates are way, way down.

Social commentators are talking of a “New Roaring ‘20s” and many analysts and economists see a boom ahead:

“Open the Door to Optimism for 2021” — BlackRock

“U.S. Will Be Ready for Liftoff After Mass Vaccination” — Morningstar

“Outlook 2021: Things Can Only Get Better” — Commonwealth Financial Network

“2021 Global Outlook: The Second Coming” — Russell Investments

“The Second Coming?” Wow.

The economic sentiment has swung, and I’m glad you all held tight last year to enjoy the rebound party!

A year ago, at the end of the first quarter, amidst market panic and economic downfall, I wrote:

“Most importantly, we know that for anyone holding diversified portfolios, we DO NOT RUN. We do not want to “sell low,” likely locking in losses and missing the recovery.” (Do Not Run from Bears - Intrinsic Value Blog)

A few days later, with our situation rapidly changing, and the economy being closed in an effort to slow the spread of the Coronavirus, I wrote:

“Similarly, when things look the worst, it’s hard to imagine how they’ll ever improve, and yet they always do. In times like today, remember the Stockdale Paradox: expect a rough road ahead, but with history as your guide, never stop believing that the good days will return.” (Investing During a Pandemic - Intrinsic Value Blog)

Eyes on the Horizon

Investments had a robust recovery and soared ahead, indeed providing plenty of good days. The analysts’ forecasts that I linked above point to a period of robust economic growth as the economy continues to reopen. Here is a slide deck from DFA with a breakdown of Q1 2020 investment returns.

So, what are we watching now?

Inflation. It appears the pieces are in place for higher future inflation. While we want to make sure portfolios are well positioned for inflation, the real concern is on the financial planning front and how a rising cost of living could affect your personal financial goals and retirement lifestyle. Inflation can impact many areas of your financial life, and we will be mindful of this threat in our planning. I spoke about planning for inflation on this month's "Money Matters" radio episode.

Taxes. Tax planning is a cornerstone of our wealth management approach. With rates heading higher, and many elements of the tax mechanism currently under debate, proactive tax planning will continue to be key in turning your efforts from labor and market gains into real, spendable dollars. Given the multi-year gains that stocks have provided, the need to maintain a balance in investment allocations, and the likelihood of higher future rates, 2021 may be a year of strategically recognizing taxable gains.

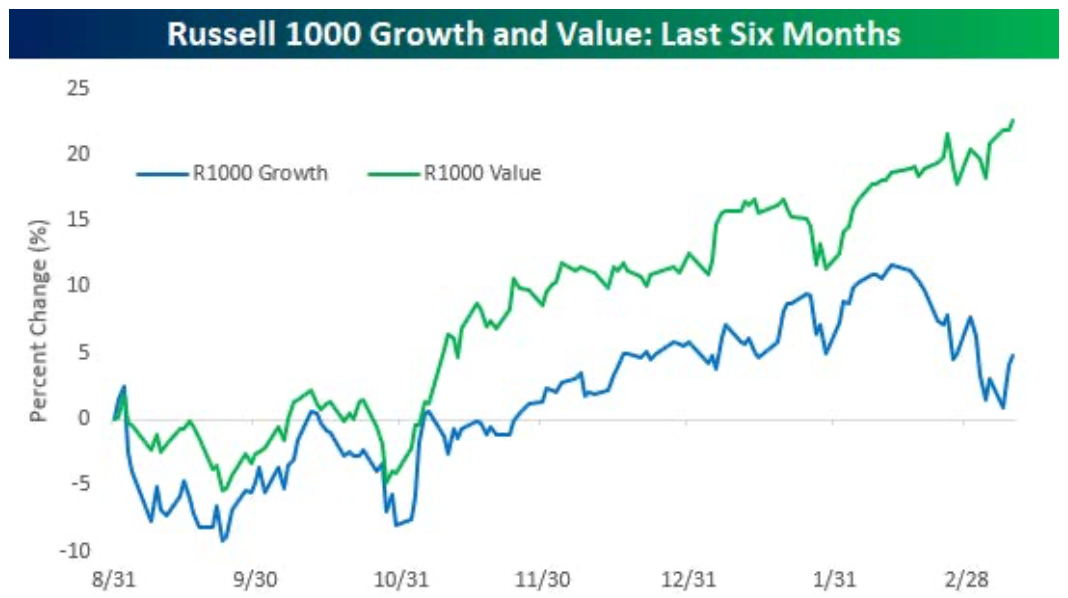

Bargain Hunting. For some time, we’ve been watching a large run-up in stocks with high price-to-earnings per share ratios, and, in particular, have been cautious around the market concentration in a very small number of very large technology companies. We have worked to manage our exposure to these higher-priced “growth” stocks and tilted into shares of cheaper value-oriented companies, smaller stocks, and those with higher profitability. Over the past six months, market leadership has shifted with strong returns coming from the value side of the market and small stocks, in particular. Historically, these trends have run for multi-year periods.

The Russell 1000® Value Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Source: Bloomberg and Bespoke

Many international stocks, particularly those based in or marketing to emerging market countries, are attractively priced and may benefit from an expanding global economy.

Looking out 10 years, here’s a very interesting discussion (printed report & podcast) from Capital Group on “The World in 2030: Investing for the Next Decade.”

Plan and Prepare

While there are currently some strong cases for optimism and a new “Roaring Twenties,” we will continue to employ a highly diversified approach, with an aim to moderate downside risks. While the dance floors were hopping with the Charleston and the Fox Trot during the 1920s, Jeremy Grantham of GMO investments is currently “Waiting For The Last Dance” with a dire warning of an asset bubble ready to crash. Grantham is noted for his frequent pessimism, but also for getting a few big calls right.

As always, we will continue to plan for the best and prepare for the worst. Our approach of integrating financial plans with investment portfolios has helped us work to ensure financial goals are met through good times and bad.

If you have any questions or concerns, or have a friend or family member who could benefit from our services, please feel free to get in touch anytime!