Trick or Treat? A Letter to Clients (2020 Q3)

As Halloween quickly approaches, it seems as if we've already been handed more than our fair share of surprises and tricks this year, haven't we?

2020 has thrown a lot at us. From a financial standpoint, the stock market's historic 34% plunge in 33 days and the economy grinding to a halt were certainly no treat!

Monsters Hiding Around the Corner?

Now, the election is on people's minds. I've frequently told clients, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This is actually a quote from Benjamin Graham, Warren Buffett's mentor, in his seminal 1934 book, Security Analysis. When using this saying, I am typically referring to day-to-day stock price swings as they react to different pieces of information or are subject to investors' own unique needs for cash or ability to invest, but that over longer periods of time, a stock's return will tend to reflect the company's fundamentals.

With the presidential election looming, the "voting machine" part of this stock market quote certainly seems to carry extra weight! However, the general statement holds true: elections—lead-ups to elections, in particular—typically cause market turmoil. We're seeing that now. However, historically this has been remarkably short-lived, and after the elections, markets quickly return to being "weighing machines" that focus on company fundamentals: earnings, profits, book value, and other measures that form a stock's intrinsic value.

In fact, in the last 20 election years, 18 ended up posting positive returns! The two negative election years, 2000 ("Tech Wreck") and 2008 (Global Financial Crisis), were results of large asset bubbles crashing, circumstances that were seemingly well beyond election results.

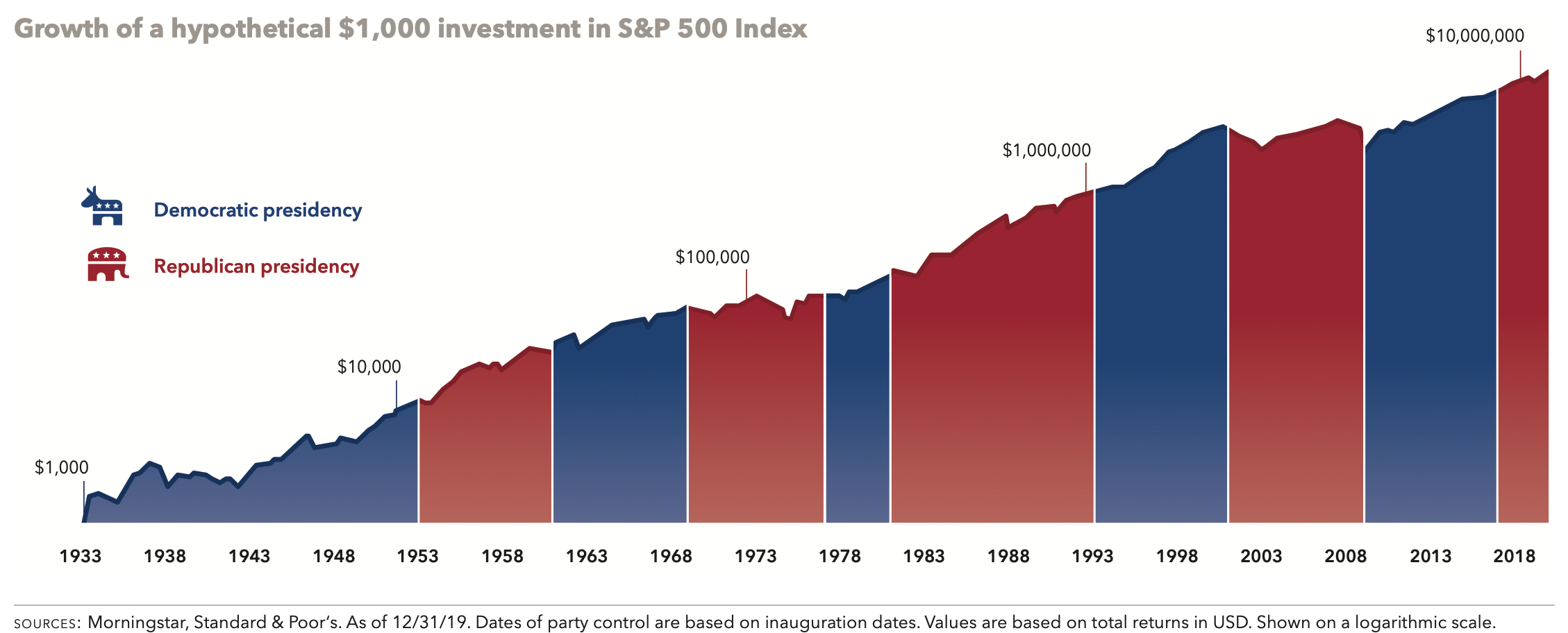

Need more convincing that history has shown that elections do not cause irreversible downturns in the market? Consider this: if one of your ancestors had put $1,000 into the S&P 500 stock index in 1933, ignored politics, did not sell or pull funds out when the "other guys" won, and courageously remained invested through the many, many scary geopolitical events that occurred between then and now, that $1,000 would be worth $10,000,000 today!

Take a look at this chart from Capital Group showing the incredible growth of $1,000 in the S&P since 1933. The investment returns were consistent, even when "those idiots" on the other side were in power!

Capital Group’s “Guide to Investing in an Election Year” research put it bluntly:

“Politics can bring out strong emotions and biases, but investors would be wise to tune out the noise and focus on the long term. That’s because elections have, historically speaking, made essentially no difference when it comes to long-term investment returns.”

Dimensional Fund Advisors (“DFA”) put together a detailed breakdown of each presidential term(s) shown in this chart. Here is a slide deck from DFA with a breakdown of Q3 2020 investment returns.

Get Ready for More Surprises!

In my “Money Matters” WTIP radio spot earlier this month, I talked about why it pays to be a long-term optimist regarding your finances, and I touch on many encouraging indicators of global progress. You can listen to my radio interview here.

If the spookiness of this election year is causing you stress, remember the onward and upward trend of this chart, and that the global human condition has dramatically improved over the years in so many ways (see footnotes!). There will undoubtedly be rocky periods along the way, and the past does not guarantee the future, but there is a likelihood that in the future, you will be pleasantly surprised at how much growth and progress from which we have all benefited.

As always, please feel free to contact me at any time with questions about your financial portfolio or plan.

Sincerely,

Scott