Maximizing Wealth: The Role of Net Unrealized Appreciation in Portfolio Management

This guest post is provided by Vanguard.

Key takeaways:

Net unrealized appreciation (“NUA”) allows for a portion of the value of employer stock held in a retirement plan to be taxed at preferred long-term capital gains rates.

There are strict rules that must be followed for the proper execution of NUA tax treatment.

The decision to take advantage of an NUA strategy should be made with consideration about whether the investor’s objective is maximizing income, tax efficiency, or total wealth accumulation.

According to How America Saves 2025, 8% of Vanguard’s employer-sponsored plans offer company stock, with 7% of the nearly 5 million plan participants investing in their employer’s stock. For those investors who acquire employer stock in their retirement plan, there’s an opportunity for them to take advantage of a tax strategy known as net unrealized appreciation (“NUA”). This strategy allows for the preferred tax treatment on the sale of employer stock after its “in-kind” distribution from the plan, rather than taxing the full amount of the distributions at ordinary income tax rates. While this may seem like an obvious strategy for many investors, before making any decisions, investors need to consider the rules around the NUA transaction and their individual objectives.

How Does NUA Work?

NUA is the difference in value between the cost basis of shares of employer stock and their current market value. When used as a tax strategy, NUA allows investors who participate in an employer-sponsored qualified retirement plan, also known as a 401(k), to take advantage of preferred capital gains tax treatment on employer stock held within their plan account.1

Without an NUA strategy, an investor would liquidate their retirement plan investments and distribute the cash proceeds or roll them into an IRA. Rollovers to an IRA are tax-free, but other distributions from either the 401(k) or the IRA are generally taxable as ordinary income, regardless of how that growth was generated in the plan.

With an NUA strategy, an investor can distribute employer stock in kind from their retirement plan into a taxable account, meaning the shares are transferred without first selling them to convert them to cash. At this point, the distribution is taxed at ordinary income rates, but only to the extent of the stock’s cost basis.2 The tax on the growth of those shares is deferred until the shares are sold from the taxable account.3

“Planning point: Many NUA transactions, particularly for publicly traded stock, will be straightforward. However, some employers will set restrictions on the plan distributions or the transferability of employer stock that could present obstacles to using the NUA strategy. Investors should evaluate company and plan restrictions prior to planning an NUA transaction.”

Summary of tax implications

1. NUA distribution of shares into a taxable account:

a. Ordinary income tax is paid on the cost basis of the distributed shares.

b. There is no immediate tax on distributed gains.

2. Subsequent sale of distributed shares from the taxable account:

a. The NUA-distributed gains are taxed as long-term capital gains, even if the appreciated stock is sold immediately after distribution.

b. Gains realized after NUA distribution are taxed based on their holding period following the NUA transaction.4

The NUA Rules

“Planning point: There is a significant trade-off in executing the NUA strategy. The full amount of the cost basis for NUA-distributed tax lots will be taxable at ordinary income tax rates in the same tax year. Investors should consider the impact of the NUA on adjusted gross income and the possibility of additional taxable transactions following the distribution. The decision to diversify the concentrated position after distribution will lead to additional tax consequences.”

1. NUA treatment can only be used for employer stock or stock funds.

NUA is available on corporate stock only when it’s the stock of the organization that sponsors the employer plan. Typically, this will be the employer’s stock. Stock funds may also qualify if they can be converted to individual shares for distribution. Stock options and phantom stock, like restricted stock units, don’t qualify for NUA treatment.

2. The employer stock must be distributed as part of a lump-sum distribution of plan assets.

A lump-sum distribution in this context requires that all plan assets be removed from the plan the same tax year as the NUA in-kind distribution. How those assets are removed is up to the investor. The employer stock may be distributed in kind while the remaining plan assets are rolled over to an IRA. Also, NUA isn’t an all-or-nothing proposition. It’s important to evaluate the employer stock at a tax lot level to receive the most benefit from NUA tax treatment. It might make sense to only distribute the stock with the lower cost basis in an NUA transaction and roll over the tax lots with a higher cost basis to an IRA.

3. NUA can only occur following one of these triggering events:

Separation from service, typically at retirement.

Reaching the age of 59.5.

Death of the employee.

Disability of a self-employed individual.

Once a triggering event occurs, the next distribution needs to be part of the NUA strategy. Both the in-kind distribution of employer stock and the liquidation of the retirement plan account need to take place during the same tax year. If the NUA strategy isn’t completed, the triggering event is lost. To take advantage of the NUA strategy, another triggering event must occur.

“Planning point: It’s important to consider all rules related to retirement plan account withdrawals. For example, an employee who separates from service by joining another company may qualify for NUA, but if they’re under age 59.5, early withdrawal penalties will still apply.5 Another example is an employee who reaches the age of 59.5 but isn’t ready to retire. They may not be able to execute an NUA transaction because their employer plan doesn’t allow in-service withdrawals.”

Case Study 1: Impact of Cost Basis

Eilon is 67 years old and ready to retire. He’s evaluating his options regarding the employer stock held in his 401(k) plan. He’s interested in executing an NUA strategy but is concerned about the tax impact of taking a large distribution in a single year.

He currently owns 2,500 shares of stock worth $500,000, composed of the following tax lots:

Corporate stock tax lots held in 401(k)

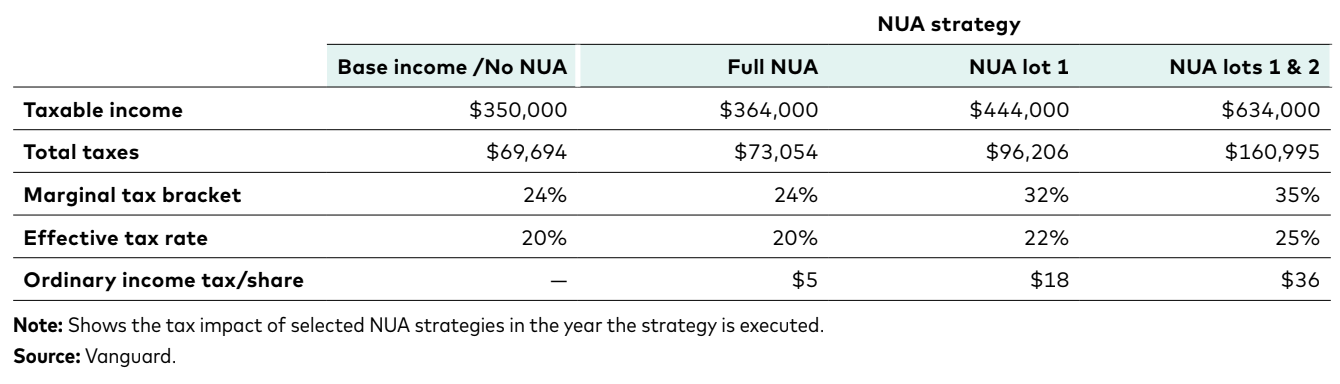

Eilon evaluated the tax implications of distributing different combinations of tax lots to determine his best option. He and his wife, Sarah, have a current combined taxable income of $350,000, so any evaluation would need to include this baseline.

Analyzing the impact of cost basis on different NUA strategies

“Planning point: While it’s helpful to understand the distribution’s immediate impact, the analysis needs to consider other information. For each option, there are additional tax and wealth implications for the investor based on the role an IRA plays in their overall plan and whether their objective for these funds is for retirement income or to be part of a broader wealth transfer strategy.”

His analysis showed that the higher cost basis on the shares and the bracket creep both led to a much higher tax per share for converting the full amount of employer stock.

After the analysis, Eilon and Sarah decided to meet with their advisor to understand how different NUA strategies could affect their cash flow and broader retirement income plan. Their advisor considered four scenarios for distributing their employer stock:

Roll over all employer stock to an IRA (No NUA).

Distribute only the employer stock with the lowest cost basis using NUA treatment and roll over the remaining shares to an IRA (NUA lot 1).

Distribute the employer stock with both the lowest and mid-level cost basis using NUA treatment and roll over the remaining shares to an IRA (NUA lots 1 & 2).

Distribute all employer stock with NUA treatment (Full NUA).

Case studies 2 and 3 look at two possible outcomes for Eilon and Sarah that consider two different scenarios. The first seeks to use the employer stock assets as part of Eilon and Sarah’s cash flow for the next 20 years. The second seeks to use these assets as part of their expected wealth transfer.

Case Study 2: Retirement Income-Focused Portfolio

In this scenario, the goal is to use the employer stock held in Eilon’s 401(k) account to fund additional retirement income. Eilon plans to retire at the end of the year and to complete the NUA in January of the following year, when Eilon’s and Sarah’s income will decrease to $150,000. The couple is comfortable maintaining their concentrated position in the employer stock, so they don’t plan to diversify after distribution. They want to maximize the amount of tax-adjusted income they can receive from this stock through a combination of IRA withdrawals and the sale of employer stock.

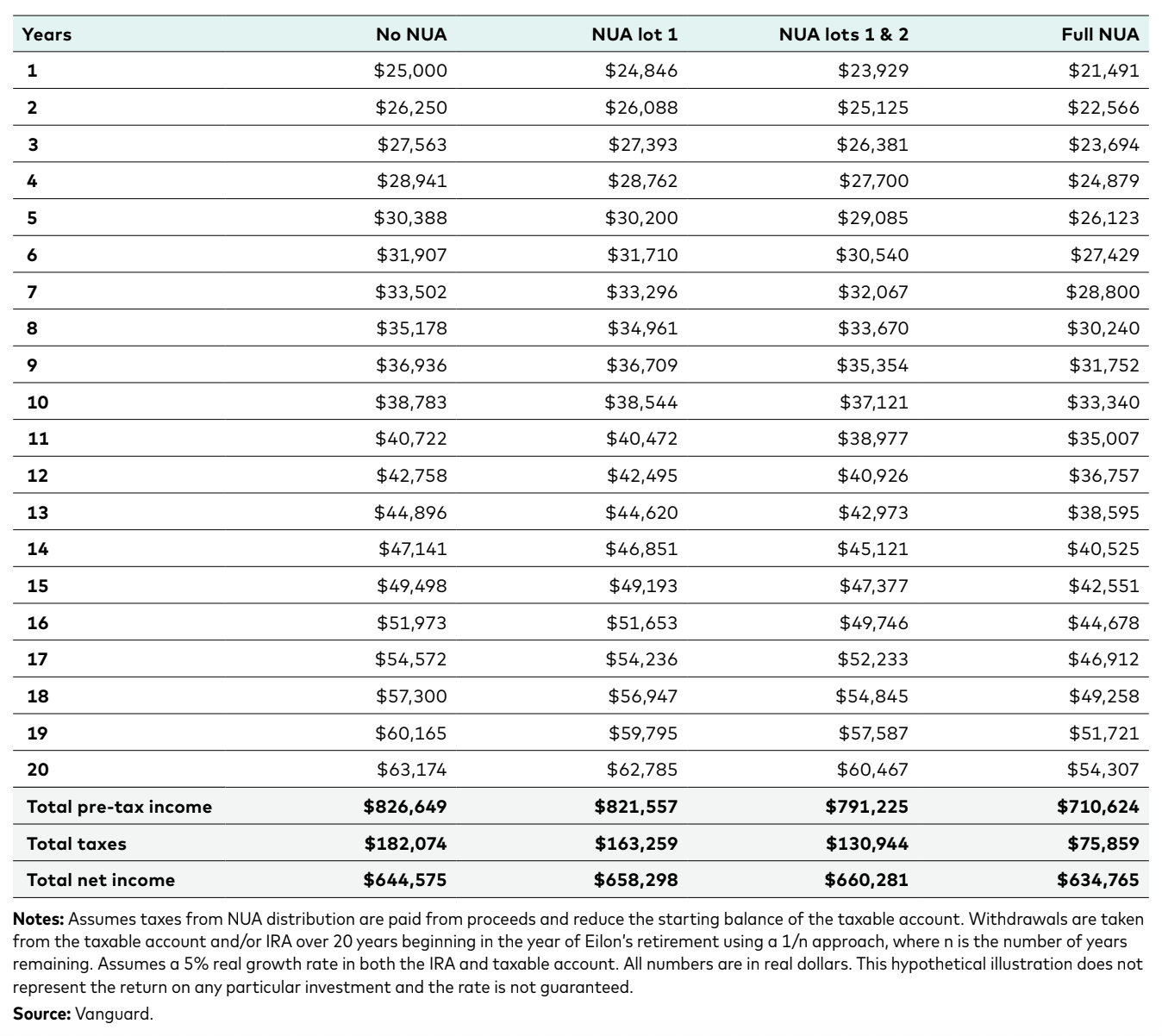

Total annual income from selected NUA strategies

Their primary goal is to maximize the total amount of available income, with a secondary goal of minimizing taxes. Using the 20-year anticipated timeline and evaluating cash flow annually, they elected to use NUA treatment for tax lots one and two, and roll lot three into their IRA. While this generated less gross income than some other options, it created the second lowest tax liability of the four options and provided the highest net income over the 20-year time horizon.

“Planning point: An investor’s cash flow needs should be considered before adopting a particular strategy. For example, investors seeking to escalate income more quickly in later years may benefit from a different strategy than those who wish to enjoy more income in earlier years. It’s important to tailor cash flow planning and NUA solutions to individual investor needs.”

Case Study 3: Total Wealth Transfer

Eilon and Sarah decide to pull sufficient retirement income from other sources and wish to use the employer stock assets for wealth transfer purposes. Their only goal is to maximize the total ending value of their employer stock assets when they pass them to their children.

The plan is to complete the NUA in the first year of Eilon’s retirement, when they have less income, about $175,000 annually.6 Eilon also plans to completely diversify any distributed employer stock into a balanced portfolio that they believe will provide lower returns than the employer stock. At this point, all proceeds from the employer stock will be left to grow for transfer to future generations. Any required minimum distributions from the IRA will be reinvested into the taxable account, net of the taxes due.

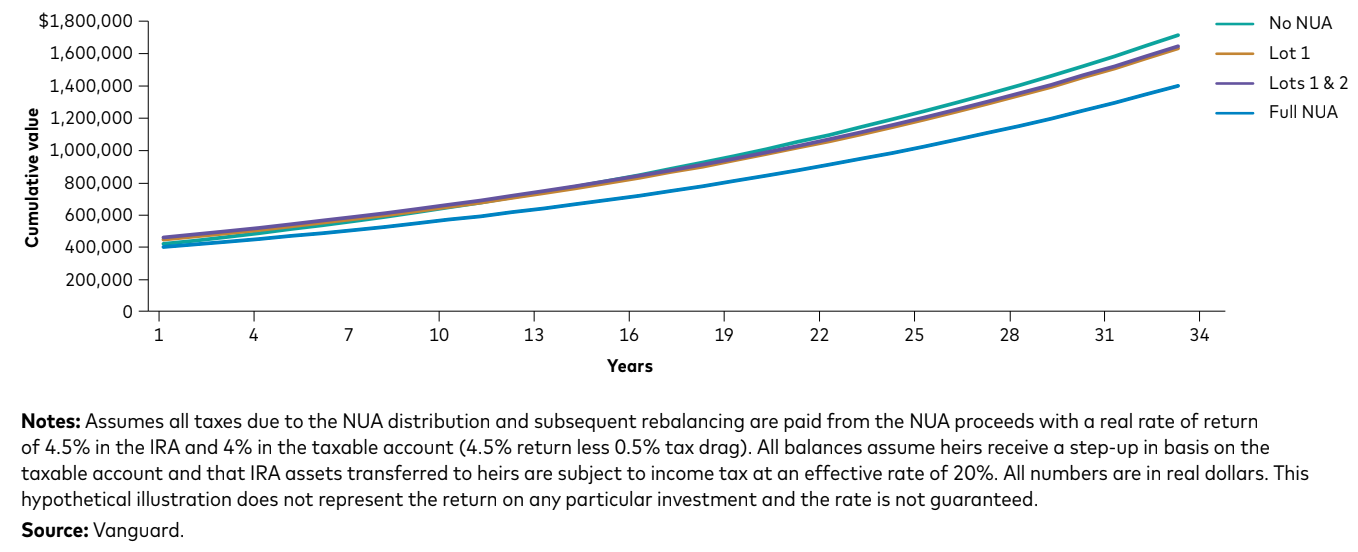

Annual Total Value of Four NUA Strategies

Looking at the projected future balances of their accounts, Eilon and Sarah decide not to elect NUA treatment for their employer stock and instead transfer it all to an IRA. In their early retirement years, the after-tax balances were higher for other strategies. However, the IRA’s higher net return meant the no NUA strategy left more for their heirs after approximately 15 years, which was well within their joint life expectancy.

“Planning point: The benefits received from an NUA strategy are sensitive to many factors, including the stock’s cost basis, assumed rates of return, and the investor’s tax position. A personalized cash flow analysis is essential to the success of an NUA strategy.”

Although case studies 2 and 3 both focus on the same couple with the same corporate stock holdings, they illustrate how the couple’s different needs for retirement planning and wealth transfer led them to choose different strategies for each. What made sense for retirement income was different from what worked for wealth transfer. Understanding the rules of the NUA strategy and the individual investor’s needs is essential to determining not only whether the strategy makes sense, but also to what extent. Digging into the details can put investors in the best position to ultimately meet their needs and make the right individual choice. Advisors can add value by working with their clients to help them understand whether an NUA strategy is appropriate for them. They can also talk their clients through the various distribution strategies and potential impacts to help determine the best way for them to proceed.

The NUA tax strategy can also be used with an employee stock ownership plan.

Cost basis in this context refers to the value of the stock when it was granted in the retirement plan.

All gains distributed into the taxable account using NUA tax treatment are subject to long-term capital gains tax rates, regardless of how long they were held in the retirement plan. The tax treatment on future growth in the taxable account will be determined by the holding period from the date of the NUA distribution.

Gains accruing after the distribution and realized in the first 12 months are treated as short-term gains.

An exception may exist if separation occurs in or after the year the employee turns 55. Check with your tax advisor for details.

In this scenario, Eilon and Sarah’s income needs remain consistent, but they have decided to fund the additional $25,000 annual income need with non-401(k) assets. This allows their employer stock to be directed toward maximizing their wealth transfer.

All investing is subject to risk, including the possible loss of the money you invest. Because company stock funds concentrate on a single stock, they are considered riskier than diversified stock funds. Diversification does not ensure a profit or protect against a loss.

There are important factors to consider when rolling over assets to an IRA. These factors include, but are not limited to, investment options in each type of account, fees and expenses, available services, potential withdrawal penalties, protection from creditors and legal judgments, required minimum distributions, and tax consequences of rolling over employer stock to an IRA.

This information is for general guidance only and does not take into consideration your personal circumstances or other factors that may be important in making investment decisions. We recommend you consult a financial or tax advisor about your individual situation before investing.