The Russian Bear and Your Wealth

Adapted From a Letter Sent to My Private Wealth Management Clients on March 1, 2022

Over the past several days, we have been sickened as Vladimir Putin’s Russian troops invaded Ukraine, intent on overthrowing the democratically elected government and confiscating Ukrainian land. I have also been inspired by the acts of bravery of the Ukrainian people, and their remarkable defensive efforts against all odds. As Russian troops invade Ukraine, and we wish the best possible outcome for the Ukrainian people, it is natural to be concerned about how the market and economic reverberations from this invasion will impact your financial future.

How badly will the marauding Russian bear bite the markets?

Stock Market and Uncertainty

It is an overused truism that the stock market hates uncertainty.

While earnings and corporate growth have been strong, markets have already been wrestling with inflation, expected interest rate hikes, supply chain disruptions, and stretched valuations in certain sectors in early 2022. Now, war in Ukraine, which is expected to disrupt European energy and commodity supplies, as well as fears the war will devolve into a larger prolonged conflict, bring additional great uncertainty and corresponding volatility to the markets. Strong sanctions from across the globe have delivered an immediate financial shock to Russia. At this point, Russian stocks and the Ruble have plunged about 30%. With the mounting array of financial measures being taken against Russia, it seems this could quickly push the country to financial and economic collapse.

Last week, the S&P 500 market index touched the -10% “correction” mark. A -20% return commonly denotes a “bear market.” Will the Ukrainian war send us into bear market territory and/or an economic recession? Despite prognosticators’ attention-grabbing headlines, no one knows. It would be prudent to prepare your financial plans and mindset for a major economic disruption.

Capital Market Performance During Times of War

A historical look at war-time market performance offers hope. Vanguard post, “Ukraine and the changing market environment” has examined major geopolitical events throughout the past 60 years and found that while equity markets often reacted negatively to the initial news, geopolitical selloffs were typically short-lived and returns over the following 6- and 12-month periods were largely in line with long-term average returns. On average, stocks returned 5% in the six months following the events and 9% in the 12 months after the events, as shown below.

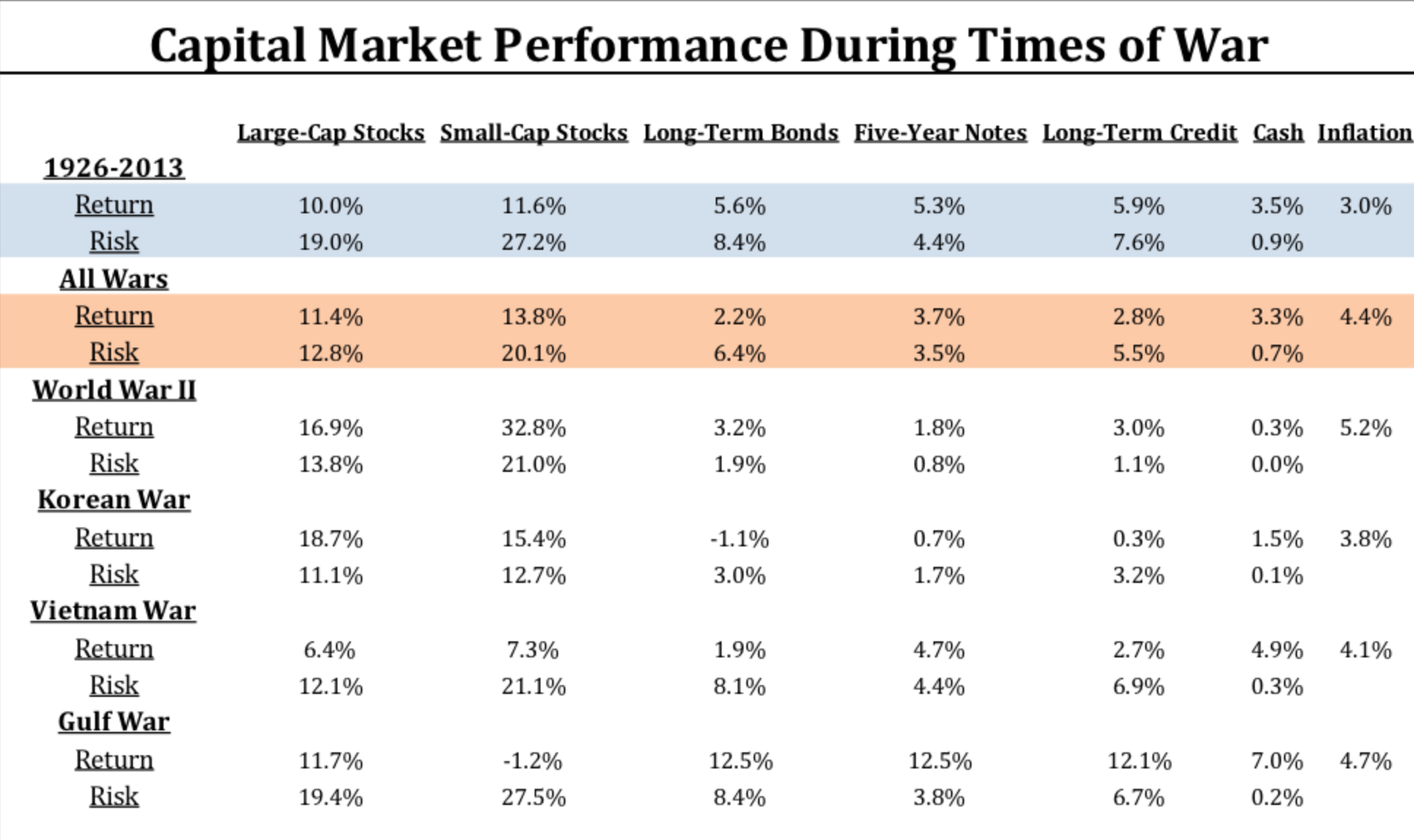

In the CFA Institute post, “What Happens if America Goes to War,” Mark Armbruster analyzes stock market returns during the longer major conflicts of World War II, as well as the Korean, Vietnam, and Gulf Wars. His findings?

“Both large-cap and small-cap stocks outperformed with less volatility during war times... It is interesting to note that stock market volatility was lower during periods of war. Intuitively, one would expect the uncertainty of the geopolitical environment to spill over into the stock market. However, that has not been the case, except during the Gulf War when volatility was roughly in line with the historical average.”

What Should We Do Now?

If our financial situation does devolve, here are a few points to keep in mind:

Bear markets can be painful, but, overall, markets are positive much of the time. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Put another way, stocks have been on the rise 78% of the time.

Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 991 days or 2.7 years.

Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 34% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun. In other words, the best way to weather a downturn could be to stay invested since it’s difficult to time the market’s recovery.

We have planned for bear markets. Our plans do not rely on avoiding such inevitable downturns, but, rather, on not relying on volatile assets for spending needs during what have been temporary downturns.

Portfolio risk management and using financial plan modeling to match portfolio assets with their expected timeline for usage is at the core of our approach. These portfolio models are “all-weather” strategies, built with an eye to the past—learning from what has worked in good times and bad—and an eye to the future by stress-testing plans with forward-looking Monte-Carlo simulations. With this process, we are comfortable that our clients living off portfolio distributions are well insulated from market shocks. For clients who are in an accumulation and wealth-building phase, while a war and possible bear market may be a brutal reality, history has shown crisis-related market dips to be long-term buying opportunities.

“Many an optimist has become rich simply by buying out a pessimist.”

At this point, for both accumulators and people in a wealth preservation and income phase, I do not see the need for a strategic structural allocation change. We will continue to evaluate opportunities to rebalance to target allocation, capture tax losses on paper, and consider tactical portfolio leans into opportunity or away from risk. It is also worth noting that in the actively managed satellite holdings in our portfolio, there are teams of analysts in each fund buying on potential and selling unattractive holdings.

Other than to stockpile cash for a near-term spending need, I am comfortable that history has shown that broad-based selling and moving to cash would not be prudent.

Wealth, War & Wisdom

With the Russian invasion on my mind, I pulled Wealth, War & Wisdom by Barton Biggs off my shelf. Biggs was Morgan Stanley’s Chief Global Strategist and famously called the late 90s dot com bubble. In Wealth, War & Wisdom, Biggs took an in-depth look at economic and market performance during war with a specific focus on World War II. After thorough study of the market and financial impacts of WWII, what was Biggs’ recommendation?

“Equities (sic: stock ownership) are the place to be in the long run because of their proven and virtually unique ability to increase the purchasing power of capital. In my considered, but not necessarily correct, opinion, a family or individual should have 75% of its wealth in equity investments. A century of history validates equities as the principle, but not the only, place to be.”

Many would view a 75% stock allocation as high—even in the best of times—but with Biggs’ careful study of wartime economics, it demonstrates his conviction in staying invested in stocks through some of the darkest days in modern history. The Ukrainian crisis could bring on a bear market and greater economic pain, or it may result in strong market performance, similar to many past conflicts. Either way, we are prepared.

Please feel free to contact me if you have questions about your financial plan or portfolio.