Charitable Gifts of Company Stock

“We’d like to do more to help.”

In wealth management, we run into a web of interconnected hopes and dreams, fears and concerns, timelines and priorities. There isn’t usually one right path forward. There are financial, tax, and legal constraints offering a variety of paths with multiple advantages and trade-offs depending on each person’s unique situation.

One of the many truly rewarding parts of my job a as financial advisor is helping clients untangle part of this web to strategically fulfill their charitable intentions. I often hear my clients talk about how they feel like they’ve worked hard, benefited from good fortune, have attained a strong financial footing, and are now in a position where they can and want to give back to a cause that is close to their hearts. Many people would like to help change or improve something in the world and make a lasting impact; other people, such as outdoor enthusiasts, often want to help conserve wildlife and protect wild places from change.

“We rise by lifting others.”

Often clients talk about how they and their families feel a deep sense of personal benefit from their volunteer efforts and charitable giving. Clients frequently voice their desire to pass on values, foster a sense of gratitude and appreciation, and build financial acumen in their kids and grandkids. Involving children, either young or adult, in your family’s giving plan is a great way to achieve these goals, as well as provide a lead-in for family conversations about wealth, inheritance, expectations, and legacy. Even starting at an early age and with modest dollar amounts, young children can be involved in selecting charitable causes and begin to understand how to think about money.

“We love the mission and efforts of this charity, but we have to balance our giving. We have retirement goals and helping with our grandchildren’s education is also a priority.”

I typically see two factors holding people back from donating as much financial support as they’d like to help their favorite causes:

Lacking complete confidence in their own financial footing. Can they afford to give more and still manage their other financial goals and obligations?

Feeling limited to cash in the checkbook. When considering charitable giving, most people first turn to the checkbook and secondly think about leaving a charitable bequest. These options likely limit the number of gifts or delay the timing of them.

How do we approach these issues to help fulfill philanthropic purpose?

First, the personal impact of your giving can be modeled with robust financial planning process and tools, including Monte-Carlo Analysis. These models can forecast your overall net worth and income streams, and can include annual gifts, large periodic gifts, charitable bequests, and other spending and financial goals. Importantly, Monte-Carlo Analysis can stress-test multiple iterations of your plans while mimicking the impact of erratic market returns, inflation, and taxes. A baseline projection is a useful starting point, but periodically “checking the map” with updated projections will better help you navigate the financial terrain as it unfolds. With this knowledge in hand, you can consider a variety of charitable strategies.

Second, looking beyond current year cash flow (the checkbook!) and analyzing your balance sheet can often uncover significant resources to fund your philanthropic goals. Fully-taxed income in your checkbook has run a punishing gauntlet of payroll, state, and federal taxes—those dollars are hard to come by. As a result, writing checks is rarely the most efficient gifting strategy for anyone holding stock that has risen greatly in value!

Corporate executives, in particular, often find themselves holding meaningful positions in company stock acquired from company restricted stock vesting, stock options, and stock from employee stock purchase plans. With advanced charitable planning, these company stock positions, as well as real estate, private business interest, and other assets, can be evaluated as potential gifts.

“We can’t sell that stock; it’s all gains. We’ll get killed in taxes!”

In many cases, the company stock has risen greatly in value and the positions have a large tax liability attached to them, making executives/owners reluctant to sell, and, as a result, constraining lifestyle spending as well as gifting.

There are many complex rules attached to charitable giving, and I’m hardly going to scratch the surface on in this article, much less interpret and apply them to your situation—you’ll need to obtain your own expert advice—but a key point is that when completed properly, you can gift your company stock with large taxable gains to a qualified charity, let the tax-exempt charity sell the stock for you, and no taxes are paid—by anyone!

Benefits to the Giver

In addition to benefiting the recipient organization, gifting appreciated company stock could benefit you financially in a number of ways, including tax savings, portfolio diversification, and income unlocking that would otherwise feel trapped by the stock’s accompanying tax burden.

Tax Savings

The tax code has been designed to encourage charitable giving and offers many potential tax benefits. Subject to various limits, including the standard deduction hurdle and limits on percentages of AGI deductible each year, charitable gifts provide an income tax deduction. By gifting appreciated company stock (long-term holding period requirements apply), the stock owner can obtain an income tax deduction of the full market value of an appreciated security, and the tax-exempt charity is able to capture and use the full value of the gifted stock, which eliminates capital gains taxes that would otherwise apply.

It’s not just tax savings in the current year either. The value of the gift—as well as the future income and appreciative value of that gift—are removed from future annual tax returns, and may also reduce future estate taxes due.

Potential tax savings:

Income Tax Deduction for value of asset gifted.

Capital Gains Tax due is eliminated on holding that is gifted.

Future Taxable Income (e.g., dividends, interest, capital gains) generated by the gifted holding is eliminated.

Estate Taxes that would be generated by value of assets gifted are eliminated.

Portfolio Diversification

“It is better to tell your money where to go than to ask where it went. ”

Counting on a concentrated position in the stock of one company to fund your financial goals over a multi-decade time horizon is problematic, to say the least. Concentration and leverage can build great wealth, but, historically, have rarely been a formula for maintaining wealth over long periods of time!

With careful planning, there are some great strategies that can allow you to improve your portfolio in conjunction with your charitable gift. The income tax deduction from a gift could potentially offset extra taxable income from Roth IRA conversions, the income tax liability from vesting Restricted Stock (RSUs), or the exercise of Non-Qualified Stock Options (NQSOs), as well as help manage the tax liability due from the sale of capital gains assets in portfolio rebalancing.

Potential diversification benefits achieved by offsetting taxes incurred portfolio restructuring with charitable income tax deductions can include:

Moving assets from tax-deferred to tax-free positions via Roth IRA Conversion.

Moving exposure from one stock risk to thousands of stocks via sales of company stock.

Increasing investment across many high potential markets, instead of concentration in one asset class, sector, or industry through large holdings in your company stock.

Moving from a high-volatility leveraged position in company stock options to an un-leveraged “low-Beta” portfolio.

These steps can help make the transition from a concentrated high-potential return, high-risk, low-probability portfolio to a highly-diversified, high-income, higher-probability portfolio less punishing on the tax front.

Income Unlocking

While, as mentioned in the section above, deductions gained from gifting shares can help offset taxes associated with restructuring your remaining assets, there are actually mechanisms available where you are able to make a charitable gift of appreciated stock and receive income back from the amount gifted itself.

If you’re sitting on company stock, these strategies can help “unlock” the value held in highly-appreciated securities in a tax-efficient manner and provide meaningful benefit to a charitable organization. Giving appreciated stock to one of the charitable trusts (e.g., CRUTs, CRATs, CLATs, or NIMCRUTs) can allow for a few potential benefits:

Income tax deduction.

Tax-free diversification of the concentrated company stock position within the charitable trust to build a more reliable distribution-focused portfolio.

Income stream back to the donor, as well as a financial benefit to the chosen charities.

Removing value of assets gifted to trust from taxable estate, while still benefiting from income stream.

Charitable Gift Annuities (“CGA”) and Pooled-Income Funds can provide a similar combination of benefits.

Charitable Conversations with Your Advisor

There are many reasons for charitable giving, both personal and financial. As a financial advisor, I cannot emphasize enough the importance of talking with your professional advisory team prior to donating in the form of a large check to the organizations that are closest to your heart. Work with an advisor to optimize the value of your gift to both you and your chosen charitable organizations!

If you’d like to talk about your charitable giving options, please feel free to contact me anytime.

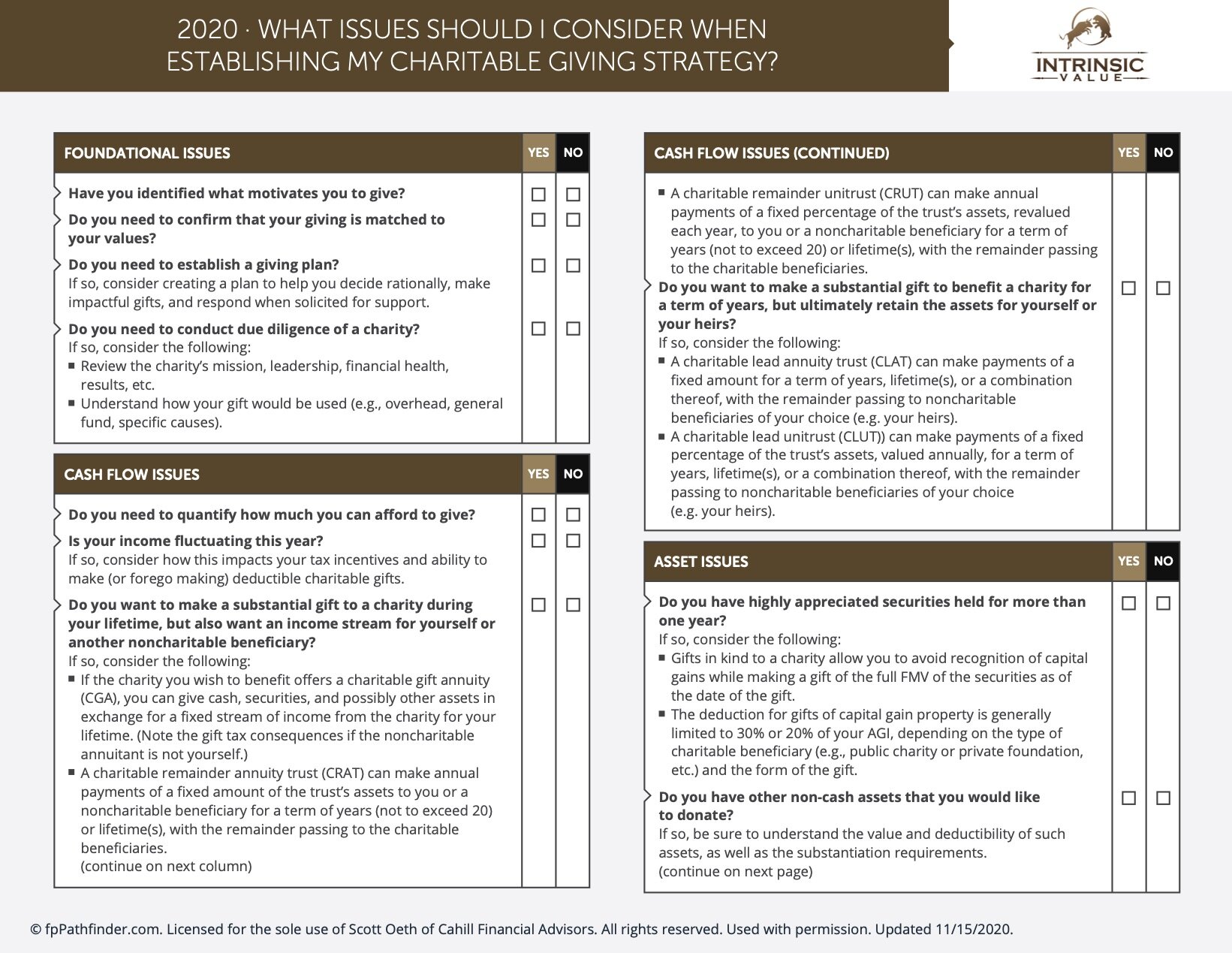

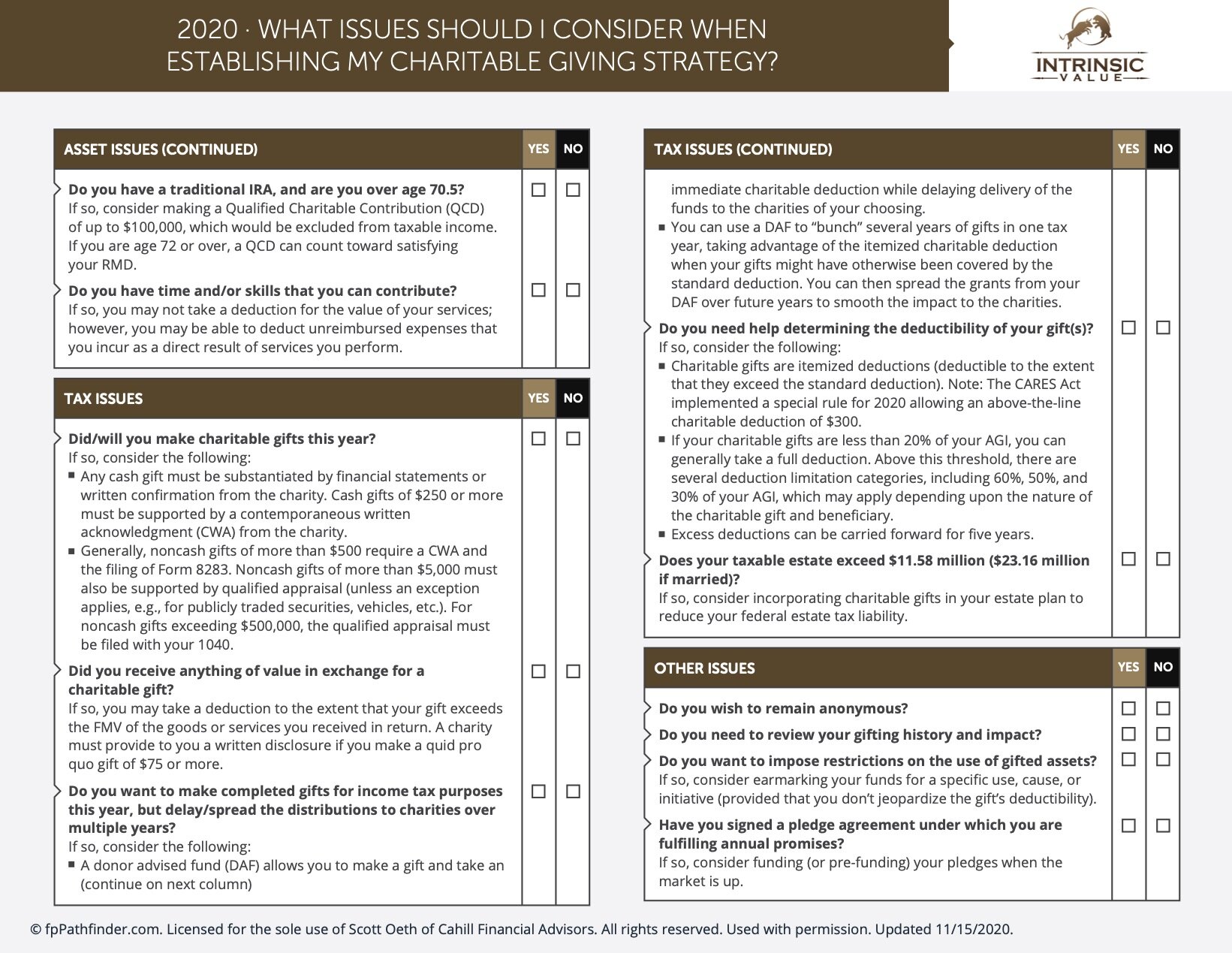

This checklist can help you begin to evaluate charitable giving strategies: